Utilizing advanced accounting software cash disbursement journal bir sample enables organizations to proactively identify and manage anomalies. For a company keeping accurate accounts, every business transaction will be represented in at least two of its accounts. For instance, if a business takes a loan from a bank, the borrowed money will be reflected in its balance sheet as both an increase in the company’s assets and an increase in its loan liability. Balance sheet is the financial statement that involves all aspects of the accounting equation namely, assets, liabilities and equity.

What is the difference between an asset and a liability?

Here we can see the list of all assets that have been reported on Hershey company balance sheet for 2023. Get instant access to lessons taught by experienced private equity pros and bulge bracket investment bankers including financial statement modeling, DCF, M&A, LBO, Comps and Excel Modeling. However, each partner generally has unlimited personal liability for any kind of obligation for the business (for example, debts and accidents). Some common partnerships include doctor’s offices, boutique investment banks, and small legal firms. Owner contributions and income result in an increase in capital, whereas withdrawals and expenses cause capital to decrease. Property, Plant, and Equipment (also known as PP&E) capture the company’s tangible fixed assets.

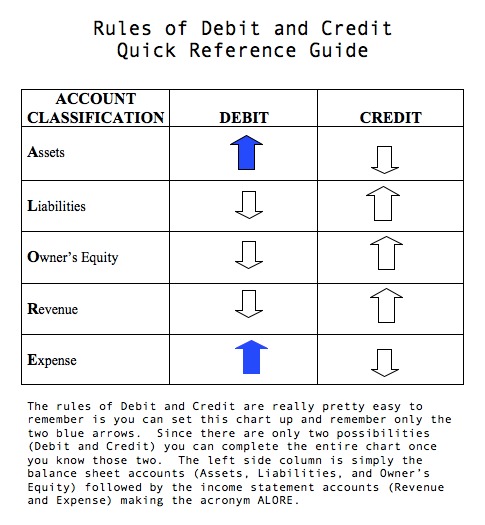

- The 500 year-old accounting system where every transaction is recorded into at least two accounts.

- If you were to take a clipboard and record everything you found in a company, you would end up with a list that looks remarkably like the left side of the balance sheet.

- Equity refers to the owner’s value in an asset or group of assets.

- Identifiable intangible assets include patents, licenses, and secret formulas.

- Balance sheet is the financial statement that involves all aspects of the accounting equation namely, assets, liabilities and equity.

- With liabilities, this is obvious—you owe loans to a bank, or repayment of bonds to holders of debt.

Example Transaction #2: Purchase of Equipment for Cash

If we rearrange the Accounting Equation, Equity is equal to Assets minus Liabilities. Net Assets is the term used to describe Assets minus Liabilities. The formula defines the relationship between a business’s Assets, Liabilities and Equity.

While they may seem similar, the current portion of long-term debt is specifically the portion due within this year of a piece of debt that has a maturity of more than one year. For example, if a company takes on a bank loan to be paid off in 5-years, this account will include the portion of that loan due in the next year. Accounts Payables, or AP, is the amount a company owes suppliers for items or services purchased on credit. As the company pays off its AP, it decreases along with an equal amount decrease to the cash account.

Ask Any Financial Question

Updates to your application and enrollment status will be shown on your account page. We confirm enrollment eligibility within one week of your application for CORe and three weeks for CLIMB. HBS Online does not use race, gender, ethnicity, or any protected class as criteria for admissions for any HBS Online program.

Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others. On 1 January 2016, Sam started a trading business called Sam Enterprises with an initial investment of $100,000. The effects of changes in the items of the equation can be shown by the use of + or – signs placed against the affected items. For every business, the sum of the rights to the properties is equal to the sum of properties owned.

Cash Equivalents are also lumped under this line item and include assets that have short-term maturities under three months or assets that the company can liquidate on short notice, such as marketable securities. Companies will generally disclose what equivalents it includes in the footnotes to the balance sheet. As a result of the transaction, an asset in the form of merchandise increases, leading to an increase in the total assets. Shareholders’ equity is the total value of the company expressed in dollars. Put another way, it is the amount that would remain if the company liquidated all of its assets and paid off all of its debts.

If splitting your payment into 2 transactions, a minimum payment of $350 is required for the first transaction. HBS Online’s CORe and CLIMB programs require the completion of a brief application. The applications vary slightly, but all ask for some personal background information. If you are new to HBS Online, you will be required to set up an account before starting an application for the program of events spotlight your choice. No, all of our programs are 100 percent online, and available to participants regardless of their location. A balance sheet must always balance; therefore, this equation should always be true.

The income statement is the financial statement that reports a company’s revenues and expenses and the resulting net income. While the balance sheet is concerned with one point in time, the income statement covers a time interval or period of time. The income statement will explain part of the change in the owner’s or stockholders’ equity during the time interval between two balance sheets. The balance sheet is also known as the statement of financial position and it reflects the accounting equation. The balance sheet reports a company’s assets, liabilities, and owner’s (or stockholders’) equity at a specific point in time. Like the accounting equation, it shows that a company’s total amount of assets equals the total amount of liabilities plus owner’s (or stockholders’) equity.

Acting as the cornerstone for financial statements, it holds the key in enabling us to understand the financial health of an organization. It is important to pay close attention to the balance between liabilities and equity. A company’s financial risk increases when liabilities fund assets. In accounting, the company’s total equity value is the sum of owners equity—the value of the assets contributed by the owner(s)—and the total income that the company earns and retains.

Liabilities are the stuff that a business owes to third parties. Along with Equity, they make up the other side of the Accounting Equation. Take self-paced courses to master the fundamentals of finance and connect with like-minded individuals. A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation.

If you were to take a clipboard and record everything you found in a company, you would end up with a list that looks remarkably like the left side of the balance sheet. A balance sheet is one of the primary statements used to determine the net worth of a company and get a quick overview of its financial health. The ability to read and understand a balance sheet is a crucial skill for anyone involved in business, but it’s one that many people lack.

The accounting equation represents a fundamental principle of accounting that states that a company’s total assets are equal to the sum of its liabilities and equity. It forms the basis of double-entry accounting, where every transaction results in a dual effect, ensuring balance sheet accuracy. One of the main financial statements (along with the balance sheet, the statement of cash flows, and the statement of stockholders’ equity).

This account includes the total amount of long-term debt (excluding the current portion, if that account is present under current liabilities). This account is derived from the debt schedule, which outlines all of the company’s outstanding debt, the interest expense, and the principal repayment for every period. A trade receivable (asset) will be recorded to represent Anushka’s right to receive $400 of cash from the customer in the future.