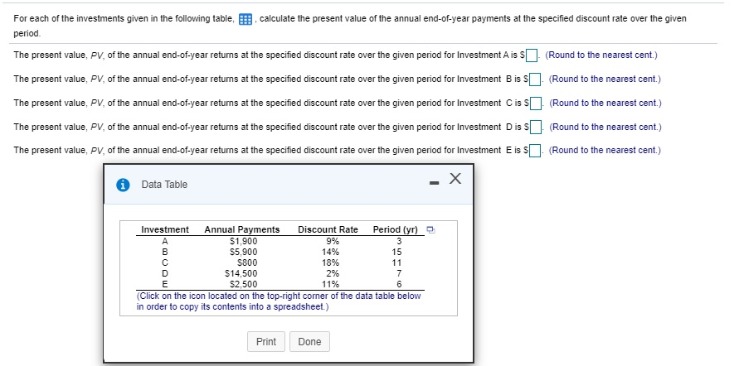

With an annuity, you might be comparing the value of taking a lump sum versus the annuity payments. Calculating the present value of annuity lets you determine which is more valuable to you. A wide range of financial products all involve a series of payments that are equal and are made at fixed intervals. The two conditions that need to be met are constant payments and a fixed number of periods. For example, $500 to be paid at the end of each of the next five years is a 5-year annuity. An ordinary annuity is typical for retirement accounts, from which you receive a fixed or variable payment at the end of each month or quarter from an insurance company based on the value of your annuity contract.

It is also used to calculate whether a mortgage payment is above or below an expected value. Using the above formula, you can determine the present value of an annuity and determine if taking a lump sum or an annuity payment is a more efficient option. Annuities are further differentiated depending on the variability of their cash flows. There are fixed annuities, where the payments are equal, but also variable annuities, that you allow to accumulate and then invest based on several, tax-deferred options. You may also find equity-indexed annuities, where payments are adjusted by an index.

Present value of a perpetuity

Payments scheduled decades in the future are worth less today because of uncertain economic conditions. In contrast, current payments have more value because they can be invested in the meantime. The present value of an annuity is based on a concept called the time value of money — the idea that a certain amount of money is worth more today than it will be tomorrow. This difference is solely due to timing and not because of the uncertainty related to time. As with the present value of an annuity, you can calculate the future value of an annuity by turning to an online calculator, formula, spreadsheet or annuity table.

The Annuity Formula for the Present and Future Value of Annuities

It gives you an idea of how much you may receive for selling future periodic payments. In order to understand and use this formula, you will need specific information, including the discount rate offered to you by a purchasing company. State and federal Structured Settlement Protection Acts require factoring companies to disclose important information to customers, including the discount rate, during the selling process. Because there are two types of annuities (ordinary annuity and annuity due), there are two ways to calculate present value.

Why Is Future Value (FV) Important to Investors?

Knowing the present value of an annuity can be helpful when planning your retirement and your financial future in general. If you have the option of picking an annuity or a lump-sum payment, you’ll want to know how much your remaining annuity payments are worth so you can choose. Even if you aren’t making that decision, knowing the present value of an annuity can give you a clearer picture the accounting equation may be expressed as of your finances. You may hear about a life annuity, where payments are made for the remaining lifetime of the annuitant (the person who receives the annuity payments). Since this kind of annuity is paid only under a specific condition (i.e., the annuitant is still alive), it is known as a contingent annuity. If the contract defines the period in advance, we call it a certain or guaranteed annuity.

You may find yourself wondering about the present value of the annuity you’ve purchased. The present value of an annuity is the total cash value of all of your future annuity payments, given a determined rate of return or discount rate. Knowing the present value of an annuity can help you figure out exactly how much value you have left in the annuity you purchased.

What is the present value of an ordinary annuity that pays 75,000 per year?

- If you simply subtract 10% from $5,000, you would expect to receive $4,500.

- But external factors — most notably inflation — may also affect the present value of an annuity.

- If you’re making regular payments on a mortgage, for example, calculating the future value can help you determine the total cost of the loan.

- You can receive annuity payments either indefinitely or for a predetermined length of time.

- But no matter what you do, it’s important to understand how the present value is established, so you know how your annuity is working for you.

Such calculations and their results can add confidence to your financial planning and investment decision-making. An ordinary annuity is a series of equal payments made at the end of consecutive periods over a fixed length of time. The payment for an annuity due is made at the beginning of accounting data entry each period.

Simply put, the time value of money is the difference between the worth of money today and its promise of value in the future, according to the Harvard Business School. The effect of the discount rate on the future value of an annuity is the opposite of how it works with the present value. With future value, the value goes up as the discount rate (interest rate) goes up. Financial calculators also have the ability to calculate these for you, given the correct inputs.

The present value of an annuity represents the current worth of all future payments from the annuity, taking into account the annuity’s rate of return or discount rate. To clarify, the present value of an annuity is the amount you’d have to put into an annuity now to get a specific amount of money in the future. The present value (PV) of an annuity is the current value of future payments from an annuity, given a specified rate of return or discount rate.

There are no guarantees that working with an adviser will yield positive returns. The existence of a fiduciary duty does not prevent the rise of potential conflicts of interest. Assuming that the term is 5 years and the interest rate is 7%, the present value of the annuity is $315,927.28. First, we will calculate the present value (PV) of the annuity given the assumptions regarding the bond. The trade-off with fixed annuities is that an owner could miss out on any changes in market conditions that could have been favorable in terms of returns, but fixed annuities do offer more predictability.

Get instant access to video lessons taught by experienced investment bankers. Learn financial statement modeling, DCF, M&A, LBO, Comps and Excel shortcuts. In conclusion, the annuity bond has a yield of 5.0% under either scenario.

Although this approach may seem straightforward, the calculation may become burdensome if the annuity involves an extended interval. Besides, there may be other factors to be considered that further obscure the computation. If you read on, you can study how to employ our present value annuity calculator to such complicated problems. Deferred annuities usually earn interest and grow in value, so that to delay the payment by several years increases the payout of the monthly payments. People yet to retire or those that don’t need the money immediately may consider a deferred annuity.